Wednesday, January 24, 2018

Sunday, October 22, 2017

60 days in Fiji

Also my first post in nearly six months. Just completed 60 days outside India. In between passed away Durga Puja, Diwali, the mandatory 15 day jetlag, and the constant setting up and settling down process and telling yourself that it shall pass soon. In a new and alien setup it's been a rivetting experience for me in every thing

new. The water, air, the sky and the lands.

I have never seen people celebrating an essentially hindoo festival in such fervour and harmony ever in my life. Buses with Diwali message, an ANZ bank ATM denoting the festival. You get everything here.

My Delhi was confused if the air post Diwali was clean, cleaner or cleanest sans dirty minds. The iTaukei people are warm and had an opportunityto drink Kava was a Senior war veteran served in Lebanon this Diwali at Kolekars' place laced with traditional clapping after each drink.

Quite a lot coming in. So keep keep looking out by this millennial (old) folk.

new. The water, air, the sky and the lands.

I have never seen people celebrating an essentially hindoo festival in such fervour and harmony ever in my life. Buses with Diwali message, an ANZ bank ATM denoting the festival. You get everything here.

My Delhi was confused if the air post Diwali was clean, cleaner or cleanest sans dirty minds. The iTaukei people are warm and had an opportunityto drink Kava was a Senior war veteran served in Lebanon this Diwali at Kolekars' place laced with traditional clapping after each drink.

Quite a lot coming in. So keep keep looking out by this millennial (old) folk.

Sunday, June 18, 2017

India Pakistan ICC Final - Who Is Going To Win?

Why India and Pakistan games are historically big?

For A Millenial it's been a big deal for the love of cricket and regional supremacy, however good Cricket wins at the end of every high wired game. This time it's The Oval and it's been almost 2 Decades 18 years since we witnessed a proper 50 over game, last time was the t20 under MS.

Dhoni, you are here today, history unfolding in front of you. The picture you shared with a rival captains infant son will go down in the history tof India Pakistan game. You, probably will be playing your last championship. You'll of course have a different profession in Delhi or Dehradoon or any place you want, you have been privy of your private life.

Virat, Bhai Hai and the young guns (guys) shall be booming today in full force.

Ab dekhna Hai, how many wickets Pakistan can down for ( whatever) target they set.

Twitter poll ends tonight.

Who is going to win India or Pakistan?

Picture source: Twitter and www.ICC.com

|

| India captain Virat |

Dhoni, you are here today, history unfolding in front of you. The picture you shared with a rival captains infant son will go down in the history tof India Pakistan game. You, probably will be playing your last championship. You'll of course have a different profession in Delhi or Dehradoon or any place you want, you have been privy of your private life.

Virat, Bhai Hai and the young guns (guys) shall be booming today in full force.

Ab dekhna Hai, how many wickets Pakistan can down for ( whatever) target they set.

Twitter poll ends tonight.

Who is going to win India or Pakistan?

Picture source: Twitter and www.ICC.com

Sunday, June 11, 2017

Is The 2017 ICC Cricket Champions Trophy The Last Millenial Tourney

Why the ICC Champions Trophy in its current format is a very Millenial thing. A big question also crops if the 8th ICC Trophy is its last? Will the 2017 ICC Trophy now pave way to an international test series going forward? These are the questions not known in the public domain?

With Virat Kohli winning the toss in a crucial game tonight with South Africa and bowling first, which means India will be given a role of a chaser. Will we finish just fine? We need to finish it off really well.

When did ICC CHAMPIONS trophy BEGIN?

Was googling Wikipedia and stumbled upon this phrase where it's described that the ICC Champions Trophy is a one day international (ODI) cricket tournament and typically organised by the International Cricket Council (ICC). It is pretty prestigious in the sense that its only second in importance after the Cricket World Cup.

Two years before the Y2K, the year 1998, when I was in class 10th Dehradoon, that was the year when it was inaugurated as the ICC Knock Out Tournament in 1998 (Bangladesh) and has been played approximately every two years since. Its name was changed to the Champions Trophy in 2002.

Indians need not to be 'overexcited' and our captain ( a Millenial) Mr. Virat Kohli, the BBC

reports "India must keep their emotions under control in Sunday's decisive Champions Trophy match against South Africa, captain Virat Kohli has warned."

All the best India.

Pic Source- Google Images

With Virat Kohli winning the toss in a crucial game tonight with South Africa and bowling first, which means India will be given a role of a chaser. Will we finish just fine? We need to finish it off really well.

When did ICC CHAMPIONS trophy BEGIN?

Was googling Wikipedia and stumbled upon this phrase where it's described that the ICC Champions Trophy is a one day international (ODI) cricket tournament and typically organised by the International Cricket Council (ICC). It is pretty prestigious in the sense that its only second in importance after the Cricket World Cup.

Why ICC CRICKET TOURNAMENT IS A MILLENIAL THING?

Two years before the Y2K, the year 1998, when I was in class 10th Dehradoon, that was the year when it was inaugurated as the ICC Knock Out Tournament in 1998 (Bangladesh) and has been played approximately every two years since. Its name was changed to the Champions Trophy in 2002.The Game Against the Proteas today at Oval.

Indians need not to be 'overexcited' and our captain ( a Millenial) Mr. Virat Kohli, the BBC

reports "India must keep their emotions under control in Sunday's decisive Champions Trophy match against South Africa, captain Virat Kohli has warned."

All the best India.

Pic Source- Google Images

Will We Stop Writing In Future?

|

| Luxor Building in Okhla- June 2017 |

What about real writing. Paper and Pen? Yesterday some friend at a gk2 restaurant was talking about his love for Kindle. The Millenial parent will understand how writing,continuously writing is important, in this increasingly digitalised world. What do you think?

Sunday, June 4, 2017

India Pakistan Game Washed? ICC Champions 2017

As we are glued towards the India Pakistan game at Edgbaston.

It was during the 90s (In South Africa) when we saw as kids Cricket as a game can be played at night as well clicked our heads, since we missed games and we had to be in the schools. D/N in Johannesburg. Terrific. We millenials saw it coming right infront our our eyes and then came the satellite TV network. Zee TV, star, DD metro, were the first. Few Russian and German channels as well.

It was during the 90s (In South Africa) when we saw as kids Cricket as a game can be played at night as well clicked our heads, since we missed games and we had to be in the schools. D/N in Johannesburg. Terrific. We millenials saw it coming right infront our our eyes and then came the satellite TV network. Zee TV, star, DD metro, were the first. Few Russian and German channels as well.

Pic source:- Getty

The ICC Champions trophy in England. We witnessed sporadic showers at the ground just made sure that the stellar game should lived to its expectations. We Won.Real Time Information Dissemination Changed PR Rules

Should I assume that social media has disrupted traditional news gathering and disseminating process and PR as well. Or should you remain positive and see that more positive information can never be negative. So how do you push all these positive energies found online towards?

Let's pray for world peace and there should be no place for terror weilding fanatics trying to change the way we people from the free world live.

Have a great week ahead...TC and cheers.

Monday, May 29, 2017

Stay Away From Social Media - Read why In India

If you are Muslim and suddenly start feeling unsafe in country where you lived for more than thousand years..

If you are Dalit and start feeling insulted on every moment of life..

If you are Hindu and suddenly start feeling that cows are being slaughtered everywhere…

If you are a Jain and suddenly start feeling that your religious piety is being compromised…

If you are punjabi and think all the youth are on drugs.

Just do one thing…

– Stay away from social media…

– Don’t watch news…

– Stay away from debates on religion…

Just look around you at your friends who belong to different castes, communities and religions…

And you will find that you are living in one of the best countries in the world!!

Saturday, February 4, 2017

Indian Union Budget Insights - 2017

The general union budget by Mr. Arun Jaitley, Finance minister this week was something like a 'short and sweet' one. The IE quotes the budget more like a Dravid than a Sehwag. No surprises and stick to the basics. The Income Tax exemption being the biggest dole out plan, is expected to raise spending in India.

The general union budget by Mr. Arun Jaitley, Finance minister this week was something like a 'short and sweet' one. The IE quotes the budget more like a Dravid than a Sehwag. No surprises and stick to the basics. The Income Tax exemption being the biggest dole out plan, is expected to raise spending in India.

While the economy is still reeling under the brunt of demonetization introduced on November 8th last year, this year’s Budget assumed even greater significance. In the past few weeks, the impact of demonization on India’s GDP has been the subject of wide spread discussions, speculation and analysis. The expectation was that while the budget would provide a fillip to economic growth.

India’s Finance Minister Mr. Arun Jaitley on 1st March 2017 announced the Budget for the

financial year 2017-2018 the central theme being rural welfare & poverty alleviation,

expansion of the tax net while simultaneously ensuring a fairer administration of tax laws,

enhancing the ease of doing business in India and providing a further stimulus to the move

towards a digital economy. In the gist the Budget has focused to “Transform, Energize

and Clean India”. The roadmap and priorities of the 2017 budget is to transform the

quality of governance and quality of life of our people.

The key tax proposals announced in Budget 2017 are as follows:

A. TAX

Reduction in individual tax rates for income upto INR 5, 00, 000/- Net Income Range (INR) Income Tax Rates Surcharge Cess (% of income-tax & surcharge)

Upto 2,50,000/- Exempt Nil Nil

2,50,000/- to 5,00,000/- 5% of (total income- 2,50,000/-)

Nil 3%

5,00,000/- to 10,00,000/- 12,500+20% of (total income- 5,00,000/-)

Nil 3%

10,00,000/- to 50,00,000/- 1,12,500+20% of (total income- 10,00,000/-)

Nil 3%

50,00,000/- to 1,00,00,000/- 13,12,500+30% of (total income- 1,00,00,000/-) 10% of

Income Tax 3%

Above 1,00,00,000/- 28,12,500+30% of (total income- 1,00,00,000/-) 15% of Income Tax 3%

2

The Budget proposes to reduce the marginal rate of tax in the income bracket between

INR 2, 50, 000/- to INR 5, 00, 000/- from 10% to 5%. Consequently, a rebate of INR

12,500/- will be available to a taxpayer across all income ranges.

Individual/HUF/AOP/BOI/artificial judicial person having income above INR 50 Lakh

will be subject to surcharge of 10% of income-tax. In case the income is above 1 Crore, the current existing surcharge will continue.

Rebate under section 87A of the Income Tax Act will be available only if total income

(i.e. taxable income) of a resident individual does not exceed INR 3.5 Lakh. In such a

case the rebate will be 100% of total income or INR 2,500/- whichever is lower.

Reduction in rates for Small Companies

Since the medium and small enterprises pay tax at effectively higher rates than large companies. In order to make medium and small enterprises more viable, the Budget has proposed a reduced tax rate of 25% (as opposed to the current rate of 30%) for domestic companies whose total turnover or gross receipt does not exceed INR 500 million (approx. USD 7.4 million).

Cross Border Taxation

5% concessional withholding tax rate on interest income earned on foreign currency denominated debt issued outside India under the External Commercial Borrowing guidelines or by way of long term bonds extended to rupee denominated bonds.

Moreover, the sunset date for such concessional rate also extended to borrowings made before July 1, 2020. Further, the sunset date for 5% concessional withholding tax rate on interest income earned by Foreign Institutional Investors/Foreign Portfolio Investors (“FPI”) and Qualified Foreign Investors on rupee denominated bonds and government securities extended to interest payable on or before July 1, 2020.

3

B. CAPITAL GAINS

For long-term capital gain, the base year will be shifted from 1981 to 2001. Fair market value on April 1, 2001 can be adopted as cost of acquisition if an asset is acquired prior to April 1, 2001.

Currently, for immovable property to be considered as a long term asset, a holding period of thirty six (36) months is applicable. With the objective of incentivizing investment in real estate, the Budget has proposed to reduce this holding period to twenty four (24) months and bring it in line with the holding period for unlisted shares.

Transfer of rupee denominated bonds issued outside India from a non-resident to another non-resident outside India will be exempt from capital gains tax.

Non-residents will not be subject to capital gains tax on the transfer (whether by way of sale or redemption) of investment, held directly or indirectly, in SEBI registered Category-I and Category-II FPIs.

A specific capital gains tax exemption has now been introduced for conversion of preference shares to equity shares. The cost of acquisition and holding period of the equity shares so converted will be the same as the preference shares.

For computing capital gains on sale of shares of a company which are not ‘quoted’ i.e. quoted on a recognized stock exchange, it is proposed that where the sale consideration received by the taxpayer is less than the FMV of such shares (as may be prescribed), such FMV will be considered as full value of consideration in the hands of the taxpayer.

In a Joint Development Agreement, capital gain shall be taxable in the previous year in

which completion certificate is issued.

C. GENERAL

Transactions above INR 3 Lakh should be permitted only by an account payee cheque/draft/use of electronic clearing system through a bank account. The limit of INR 3 Lakh will be applicable in respect of a single transaction or in respect of a number of transactions with a person in a single day.

4

Business expenditure in cash/bearer cheque/crossed cheque above INR. 10,000/- (as against INR. 20,000/-) will be disallowed under section 40A (3). Likewise under section 80G, donation given by any mode other than cash in excess of INR 2000 (as against the present ceiling of INR 10,000/-) will not be eligible for deduction.

Political party cannot accept donation above INR 2000/- in cash.

Loss from let out property exceeding INR 2 Lakh will not be deductible from income other than house property income during the current year (carry forward will be allowed).

Under the presumptive income-tax scheme of section 44D, business income will be calculated at 6% in respect of turnover of the gross receipt which is received by an account payee cheque/draft/electronic clearing system on or before the due date of submission of income.

Content Support- Lex Favios

Image Source- http://www.dqindia.com/

Sunday, January 15, 2017

Chess- A Game For India and on the Rise? Online Chess competition

India is on a digital High and the 1000 year old '' game of chess' is not untouched. Come 15th January, that's today, on a Sunday, India gears up. Vishy Anand- is our Sachin of the Chess.

The 3rd ChessBase India "Vishy Anand" online blitz tournament will be held on 15th of January 2017 at 13.30 server time (13.30 CET) on the Playchess server. The tournament is open to all the players of the world. The winner will win 12 months of ChessBase premium account along with Vishy Anand's DVD Vol.1+2. The second and third places will win nine and six months CB Premium Account + CBM 175. There are even more lucky prizes! Check out the article for more details. The 3rd ChessBase India online chess tournament will take place on the 15th of January 2017 at 13.30 server time (13.30 CET) in the Emanuel Lasker Arena on Playchess server. The tournament is held in the honour of the best chess player of India Viswanathan Anand.

|

| A Chess game under progress at a restaurant in South Delhi- Pictue taken January-2017 |

On the other hand, in the Tribal dominated district of Mandla, the hinterland will be holding a highest prize money Rs 5 lakh - tournament of central India from January 27. As per TOI, it is named as Aadi (aadi for adivasi) international open rating tournament, the event is brainchild of the district mining officer, an accomplished chess player who can play blind fold with 10 opponents at a time.About 200 participants including one grand master and three international masters have so far given their nod for the competition. Mandla is more than 450 kms away from Bhopal and is predominantly a tribal district with nearest railway station and airport located at Jabalpur about 77 kms away from the district headquarter.

The key (4) benefits of playing chess can be attributed like this.

1) Chess improves key thinking skills

2) Chess can improve your memory

3) Chess players are successful

4) Chess can make your kids smarter

India is an interesting country and the digital and mainline bit of games such as chess can co exist and gather the kind of interest it deserves, in equal measures.

PIC Source- @vishy64theking

Subscribe to:

Comments (Atom)

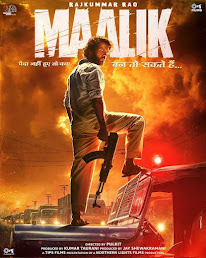

Maalik film review - a misfire of intensity and misfit

Maalik is a film that tries hard to be gritty and intense but ends up feeling hollow and overwrought. The characters operate at a constant...

-

Day 4 - Quarantined Did I tell you why it took approximately 11 hours for me to reach the airport gate? Note - the officials did the best t...

-

With a kiss let set out for an unknown world. FIJI Seems like reborn, time to learn and unlearn things in life. Came here with a blank slat...